The Institute’s inaugural cohort of climate scholars examined the power of MSCI’s scenario-analysis tool to serve as an indicator of movement in asset prices and the value of artificial intelligence in surfacing company spending as a proxy for climate readiness.

Lorena Tassone and Chiara Crupi, both master’s candidates at the University of Zurich, presented findings from their research into climate scenario analysis and capital spending, respectively, at a forum co-hosted by the MSCI Sustainability Institute and MSCI’s Climate Risk Center.

The presentations to MSCI’s in-house research team capped six months of work by both Tassone and Crupi under the supervision of members of the firm’s Climate Risk Center, which is headquartered in Zurich and brings together some of the best minds in quantitative finance and climate science to design and build new types of models and analytics.

“

Congratulations to Lorena and Chiara for successfully completing their projects, which will advance understanding applied climate finance and the transformative potential of AI in this discipline,” said Rumi Mahmood, the Institute’s research director.

“We are thrilled to share their respective findings and analysis, which deepen understanding among academic researchers and investment-industry practitioners alike.”

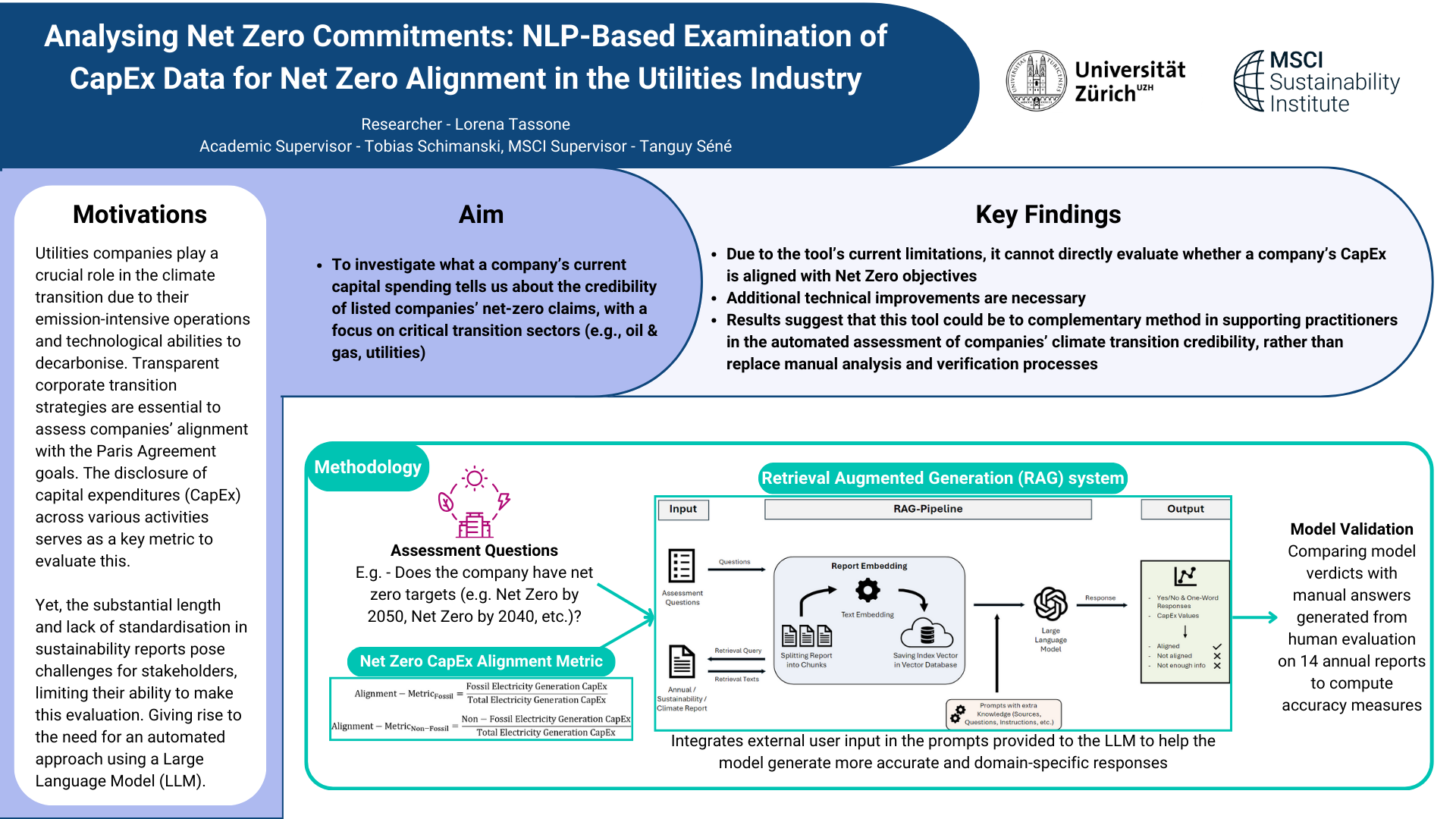

Examining capital-expenditures data from a net-zero perspective

Student: Lorena Tassone

Academic Supervisor: Tobias Schimanksi, Doctoral Researcher, University of Zurich

MSCI supervisors: Tanguy Séné and Diana Alvarez-Marin, MSCI Climate Risk Center

Capital expenditures — outlays by companies to acquire long-term assets — have emerged as a key measure of companies’ plans to transition to a low-carbon future. Allocating capital to new infrastructure or technologies that reduce emissions can help investors assess the transition readiness of portfolio companies.

Tassone analyzed how effectively capex data reflects a company’s commitment to net-zero goals by using a large language model to parse companies’ sustainability reports. The research suggests that AI can be a powerful tool for automating the assessment, particularly in jurisdictions like the European Union that have standardized climate disclosure. AI is less effective, however, at assessing alignment between capex and climate objectives in countries that have yet to standardize reporting practices, the research suggests. The insights offer a nuanced understanding of how AI can aid practitioners in evaluating corporate climate commitments.

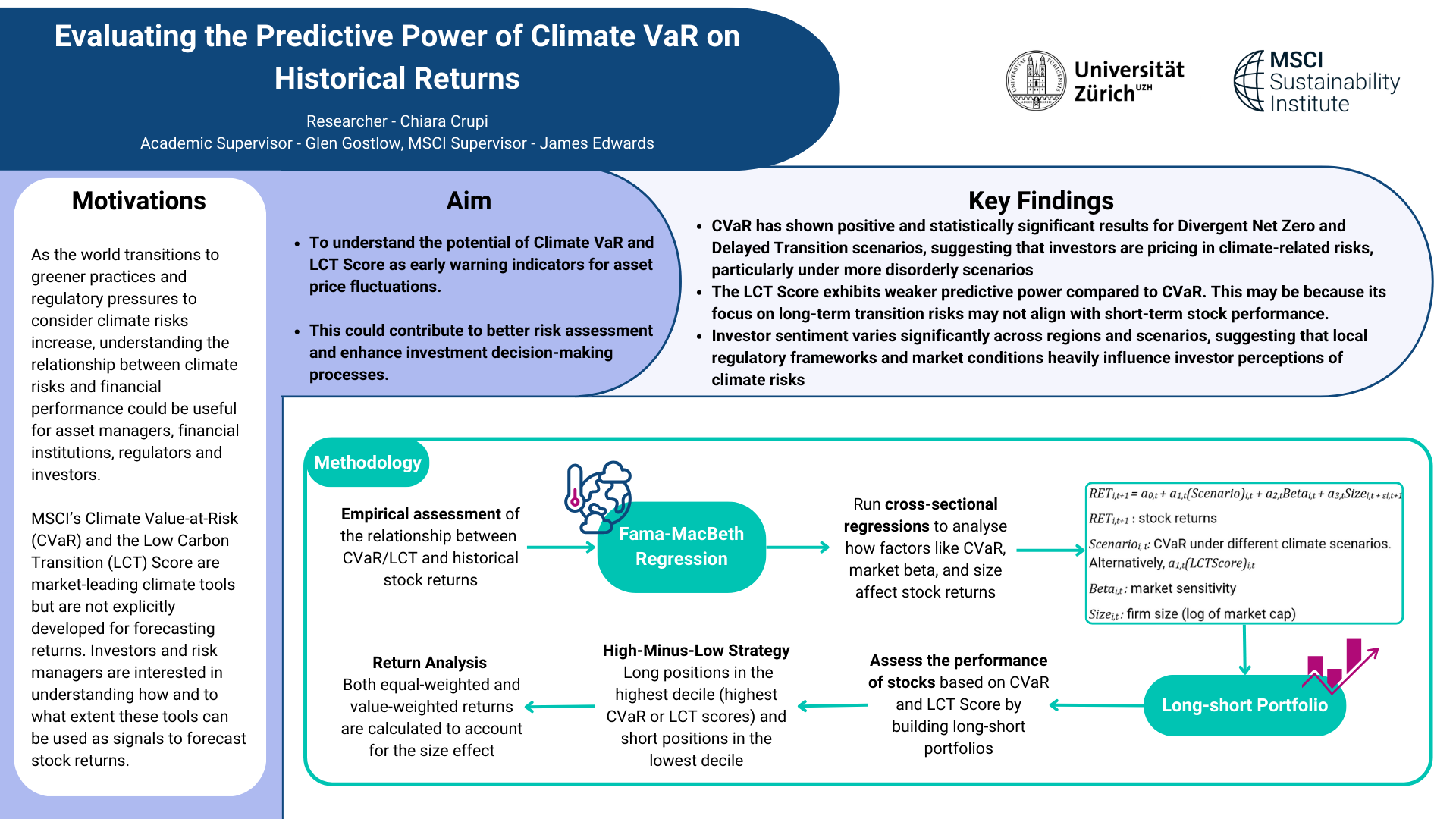

Evaluating the predictive power of Climate VaR on historical returns

Student: Chiara Crupi

Academic supervisor: Glen Gostlow, Postdoc, Department of Finance, University of Zurich

MSCI supervisor: James Edwards, MSCI Climate Risk Center

MSCI’s Climate Value-at-Risk (Climate VaR) is a forward-looking climate risk metric designed to help investors quantify the impact of climate-related transition and physical risk on companies under varied hypothetical scenarios.

Crupi’s research focused on assessing the effectiveness of Climate VaR as a tool for forecasting return. Her findings indicated that Climate VaR demonstrated positive, statistically significant predictive power, especially under two climate scenarios (Divergent Net Zero and Delayed Transition) developed by the Network for Greening the Financial System, a group of central banks and financial supervisors. The findings suggest that investors are increasingly pricing in climate-related risks, particularly in scenarios characterized by more disorderly transitions.

Looking ahead

The successful completion of both projects highlights contributions that students can make to the field of sustainable finance. We look forward to building on the work by both Crupi and Tassone as the Climate Scholars Program develops. Watch this space! Our 2025 projects will be announced soon.